Home / Media / PPFAS in News / Parag Parikh's Big Mutual Fund Bet

Turtle Talk - 30th July 2012

Dealing with behavioral biases

Parag Parikh

This article first appeared in the July 2012 edition of "The Income Tax Review".  Human thought processes are an amalgam of experience, intuition and rationality. Our actions are usually based on the belief that we know what is good for us. However, many times those actions are based on impulses which may actually be detrimental to us in the long run. Also, since the feedback mechanism is often not instantaneous, we bear the consequences of our actions much later. By that time it may be too late to remedy the situation. This behavioral tendency is visible in every aspect of our lives be it education, health, money, relationships etc.

Human thought processes are an amalgam of experience, intuition and rationality. Our actions are usually based on the belief that we know what is good for us. However, many times those actions are based on impulses which may actually be detrimental to us in the long run. Also, since the feedback mechanism is often not instantaneous, we bear the consequences of our actions much later. By that time it may be too late to remedy the situation. This behavioral tendency is visible in every aspect of our lives be it education, health, money, relationships etc.

While academics steadfastly cling to the ephemeral notion of "Rational Man", there is an irrefutable and growing body of evidence contradicting this. If humans were truly rational, then all of them would have behaved in a very similar manner. For instance, the traditional regimented route to success is : Finish your schooling, go to a "reputed" college, pursue a "safe" degree and get a "good' job, which until recently meant either a doctor, engineer or lawyer.

However, over the years, an increasing number of students have chosen to go on the road less travelled and guided by their heart, have chosen off-beat courses such as wild-life photography, linguistics, etc. At the outset, virtually no one knows whether they will be successful or not. However, that does not deter them from putting in their best effort. My point is, even in a relatively unadventurous field such as formal education, many a time, the heart rules the head.

Coming back to the core subject of this article, whenever clients visit advisors, they expect us to solve all their financial problems and want us to assist them in attaining all their financial aspirations. However, I have observed that they display several cognitive and emotional behavioral biases while interacting with us. Here are a few of them:

Optimism Bias:

Many a time, clients visit us after they have experienced some kind of financial trouble. It could be related to debt burden, the tendency to over-spend, a job loss etc. At that point they are overly optimistic about our ability to provide quick-fix solutions and immediately get them back on track. Often they fail to comprehend that it takes a joint effort on the part of both, client and advisor, to emerge out of the rut.

Representative Bias:

Many times clients compare us to their family doctor and expect that we will provide them with the equivalent of tablets which will help them recover in a few days. While, it is true that there are some parallels between the two professions, we are more adept at providing solutions which will help you in the long-term rather than the short-term. In other words, feedback mechanisms are often not instant, in our case. On a lighter note, I think it would be better if they compared us with to dieticians rather than cosmetic surgeons.

Sunk Cost Fallacy:

Clients persist with products which are unsuitable for them, simply because they have paid for them. Investment oriented insurance policies are good examples. The policies that they currently own may provide a low life cover and may be opaque & difficult to understand, Yet they are reluctant to surrender them, despite us pointing out better options. This is because they have already paid the premium for the past few years. Consequently, they are unwilling to bear any surrender-related losses, even if rationally they should be agreeing with our contention that in the long run it would be costlier to continue with the policy.

Confirmation Bias:

Often, certain long-standing beliefs have already ossified in clients' minds when they approach us and it is difficult to suggest something which is contrary to these. For instance, if we suggest increasing equity exposure to an avowed debt investor, he may diligently point out all recent instances when the equity market has crashed. At the same time, he will not accord any weightage to the stellar cumulative performance of the stockmarket over the past two decades or so.

In other words, he will cling on to examples which fortify his belief that stocks are risky and conveniently ignore the ones which disprove this belief. To such people I cite several examples of companies reneging on their debt obligations.

Bandwagon Effect:

Everyone is more bothered about what the others are investing in rather than researching which product suits them the most. For instance, over the past one year, when Fixed Maturity Plans (FMPs) were in vogue, many of our clients were keen on opting for one year FMPs merely because some acquaintance or the other had done so.

This included clients who needed to utilise the same money within the next six months and for whom the illiquidity of the FMP was a big negative. It took a monumental effort to make them jettison this idea and convince them to park their capital in short term debt funds.

While there are many more such biases, the moot point is that while dealing with humans (and especially on a touchy subject like their finances), advisors must treat irrationality as "par-for-the-course" and not be surprised at anything that confronts them. This is more art than science. That is where experienced advisors score over the rookies who merely go by what their courseware states.

Fund Focus: ICICI Prudential Discovery Fund: From the WMG Desk

Ankur Mahajan | [email protected]

ICICI Prudential Discovery Fund (IDF) is an open-ended diversified equity fund, which aims to invest in stocks available at a discount to their intrinsic value. Positioned as a value fund, the process involves identifying companies that are well managed, fundamentally strong, and are available at a price, which can be termed as a bargain. The fund assumes a bottom-up strategy for selecting stocks in the portfolio. It is a small and mid cap fund which means your money will prominently be invested in medium sized and small sized companies and in some large companies for stability. Large cap companies tend to be stable compared to mid cap and small cap companies. But mid cap companies can give kicker returns. IDF's portfolio has about 32% exposure to mid cap companies and 41% exposure to small cap companies.

ICICI Prudential Discovery Fund (IDF) is an open-ended diversified equity fund, which aims to invest in stocks available at a discount to their intrinsic value. Positioned as a value fund, the process involves identifying companies that are well managed, fundamentally strong, and are available at a price, which can be termed as a bargain. The fund assumes a bottom-up strategy for selecting stocks in the portfolio. It is a small and mid cap fund which means your money will prominently be invested in medium sized and small sized companies and in some large companies for stability. Large cap companies tend to be stable compared to mid cap and small cap companies. But mid cap companies can give kicker returns. IDF's portfolio has about 32% exposure to mid cap companies and 41% exposure to small cap companies.Portfolio:

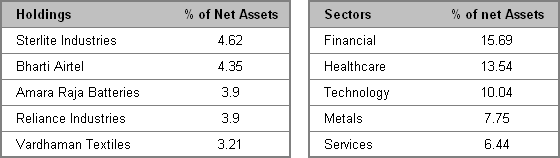

The fund's portfolio choices, however, have been largely offbeat, what with contrarian and dividend yield stocks (and sectors) with a focus on relatively low Price-Earnings (PE) stocks making up its portfolio. Having an average market capitalization of around Rs 6,203 crore, the portfolio of IDF is spread over 41% in small caps, 32% in mid-caps and around 27% in large caps companies. As per the latest factsheet released by the fund, it is sitting on a miniscule 3.25 percent of cash. The top 5 holdings and sectors of the fund are as follows:

Source: Valueresearchonline

Performance:

Over a three- and five-year period, IDF has delivered about 17 per cent and 11.5 per cent, respectively, way higher than the 10 per cent and 3.7 per cent returns managed by its benchmark CNX Midcap in the same period.

Fund Management:

In Feb 2011, Mrinal Singh took over IDF after manager and CIO-Equities Sankaran Naren CIO relinquished portfolio management responsibilities. Singh joined the fund company in June 2008 as an equity analyst and was made a portfolio manager in Aug 2009 when he was given charge of a technology sector fund. Subsequently in 2010, he assumed responsibility for managing the equity component of some of the fund company's conservative allocation funds. This fund is his first stint at running a diversified equity fund.

He also co-managed the fund alongside Naren for a six-month period as a part of the transition process before taking over the fund, and he says that he will ply the same strategy as Naren. Singh's track record on the technology sector fund he runs is noteworthy. Considering the brevity of his track record on diversified equity fund, he really needs to prove his mettle in the long run.

Our view:

You can invest in ICICI Prudential Discovery fund to grow or create wealth. But investors may be better off adopting a long-term investment horizon as the benefits of the fund's value-investing strategy and mid-cap bias can best be reaped over time. Do not look at making quick bucks here. The fund also has a history of under-performing during sustained bull phase which makes it attractive during current phase. Also, it is not advisable to make ICICI Prudential Discovery Fund as part of your core portfolio. Core portfolio is investments that are made for your basic goals. However, ICICI Prudential Discovery Fund can definitely be a part of your satellite portfolio.